Pull out your purse and wallet and take a look inside. Chances are, you’re traveling without much paper cash or coins. And while some businesses still require cash payments, most of our modern transactions have become cashless.

Cashless payments – also called digital payments – are becoming the norm for almost every industry. The ease by which you can pull out a card or smartphone and pay at a kiosk or store is definitely attractive.

Powering the cashless revolution are POS (Point of Sale) systems. These software solutions facilitate payments via credit card, debit card, or digital payment methods like Apple Pay or Google Pay. If you’ve ever swiped or tapped your card or phone at a store, you’ve used a POS system.

And where there’s a need, there’s a product (or ten) vying for your attention. From mom-and-pop shops to major retailers are investing in POS systems to stay up-to-date and competitive. One common brand is SumUp – a POS card reader system designed to help businesses easily process payments.

But did you know that there are alternatives to SumUp that may save you time, money, and hassle? Let’s take a look at the best five SumUp alternatives on the market and how you can choose the right one for your business.

What is SumUp?

SumUp offers a versatile range of point-of-sale hardware and software solutions designed to meet the needs of diverse businesses.

The company’s card readers, available in multiple configurations and price points, connect to a mobile app via Bluetooth, allowing for seamless transaction processing. SumUp is compatible with various payment methods, including chip, swipe, and contactless, and supports all major credit cards, such as Visa, Mastercard, and Amex, as well as mobile payment platforms like Apple Pay and Google Pay.

Pricing and Plans

- Costs: Merchants pay a one-time cost for the card reader and a fixed transaction fee of 1.69% per payment.

- Payment options and transaction fees:

- For in-person payments, the transaction fee is 1.69%.

- Online payments for stores, invoices, and payment links come with a 2.5% fee.

- A QR code option is available at no additional cost.

- Reader options:

- Air: £39, smartphone pairing, optional charging station.

- Air & Charging Station: £49, includes Air reader and charging station.

- Solo: £79, standalone touch-screen interface with sales history and refunds.

- Solo and Printer: £139, includes all Solo features + receipts and on-the-go charging.Card Reader Options:

- Point of Sale solutions: SumUp provides point-of-sale options for both retail stores and restaurants, starting from a one-time cost of £429 for the Lite version, and a monthly fee of £49 for the Pro version.

By offering multiple hardware options and transparent pricing, SumUp has carved out a significant space in the payment processing landscape. However, some users may find the hardware selection and pricing confusing. Fortunately, there are options available on the market that offer more straightforward pricing and fewer hardware components.

5 top alternatives to Sumup in 2024

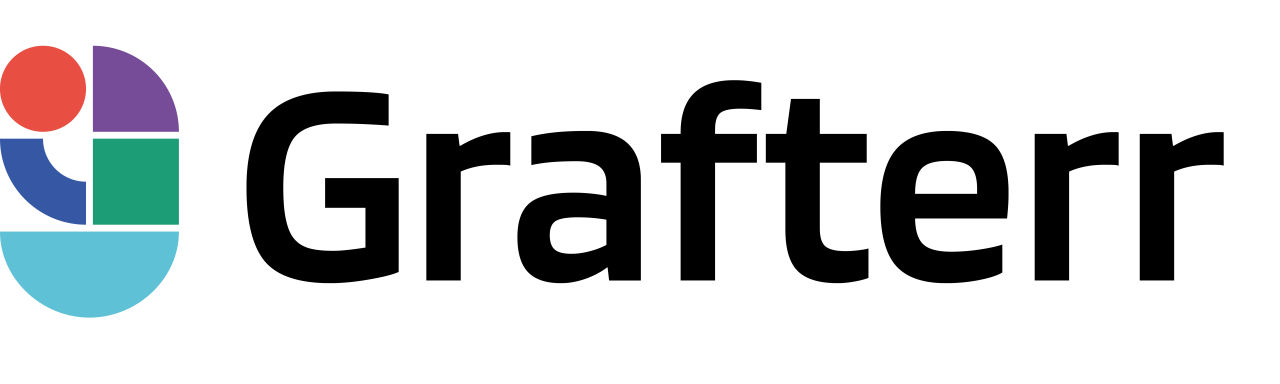

1. Grafterr GO

Grafterr GO! is a mobile point-of-sale (POS) solution designed to simplify the payment process for a variety of professionals and businesses.

The platform enables users to take both cash and card payments directly via a smartphone or tablet. Grafterr GO! aims to make it easy to get started with free sign-up and instant selling capabilities. The service also promises next-day payouts to help businesses manage their cash flow more effectively.

Features

Grafterr GO! sets itself apart with its exclusive TAP&GO! feature available for Android users, allowing them to accept payments directly on their phone without the need for a card reader.

This is particularly advantageous for businesses that need to take payments on the move and want to avoid carrying additional hardware. The platform also offers robust reporting capabilities, the option to set up promotions and discounts, intelligent modifiers and variants, as well as multi-user selling functionalities.

Pricing comparison

While SumUp offers a range of card readers starting at around $35 or £39, Grafterr GO! is currently offering their GO! Reader at a discounted price of £16.00. In terms of transaction fees, Grafterr GO! charges 1.29% per transaction and 1.79% for payment links. This is slightly lower than SumUp’s 1.69% standard transaction fee, especially when you consider Grafterr’s reduced rates for new customers for the first three months.

Both platforms have a transparent pricing model with no hidden fees or long-term contracts, but Grafterr GO! also covers PCI compliance, adding an additional layer of financial security.

Pros and cons

Pros:

- No need for a card reader with the TAP&GO! feature, making it highly portable.

- Lower initial cost for the card reader and potentially lower transaction fees for new customers.

- Comprehensive reporting and advanced features like promotions, discounts, and multi-user selling.

Cons:

- While the platform offers next-day payouts, it does not offer customer service phone number, which might be an issue for some businesses but the support is working 24/7 over tickets system and emails.

2. Square

Square is a comprehensive Point of Sale (POS) platform designed to help businesses of all sizes start, run, and grow. It offers a wide array of features to manage payments, inventory, and even employees. Square emphasizes its powerful analytics and seamless scalability to fit your business needs, irrespective of your industry.

Features

Square has robust, real-time analytics that provide insights into best-selling items, busiest hours, and top-performing team members. The platform offers high flexibility and scalability, allowing easy addition of new locations, team members, and devices.

All this data is synchronized to a single account for a unified view. Square also stands out for its ability to integrate seamlessly with existing software.

Square accepts all major credit and debit cards for payment acceptance and accommodates Apple Pay and Google Pay through its Square Reader. Square also offers custom invoicing from its POS system, adding another layer of ease for businesses.

Pricing comparison

Square offers a ‘no hidden fees’ pricing model, much like SumUp. While SumUp charges a 1.69% fee for in-person transactions, Square’s fee is 1.75%. Square offers a tiered pricing system for online transactions: 1.4% + 25p for UK cards and 2.5% + 25p for non-UK cards.

This is a bit more complex compared to SumUp’s flat rate of 2.5% for online transactions. However, Square provides a free Point of Sale system and other features like inventory management, analytics, and dispute resolution without monthly fees.

Pros and cons

Pros:

- Extensive real-time analytics for better business decision-making.

- Scalable and flexible to accommodate a growing business.

- Seamless integration with existing business software.

- Versatile payment acceptance, including digital gift cards and mobile payment methods.

Cons:

- Slightly higher in-person transaction fee compared to SumUp.

- Tiered online payment fees could be complicated for some businesses to navigate.

- Does not specify if it supports next-day payouts for non-UK transactions.

3. Zettle by PayPal

Zettle by PayPal is designed for businesses prioritizing fast transactions and smart payment tools. Originally known as iZettle, PayPal’s acquisition of the company in 2018 brought a range of new features.

Features

Zettle stands out for its wide range of payment solutions, including Tap to Pay on the phone, a compact card reader, and a fully integrated terminal. It offers multiple ways to get paid, from major cards to digital wallets like PayPal. A significant plus is that no additional hardware is needed when using Tap to Pay with your phone.

Additional features like gift cards, invoicing, and payment links add more layers of payment flexibility. Notably, Zettle invoices come with a 2.5% transaction fee, while its payment links and PayPal QR codes offer secure remote payment options for a fee of 1.75%.

Pricing comparison

Zettle’s pricing is quite competitive, with a 1.75% card transaction fee, the same as Square and slightly higher than SumUp’s 1.69%. Custom rates are also available for particular use cases.

For new businesses, the Zettle card reader is priced at a one-off payment of £29, and the terminal is available from £149, each with a 1.75% transaction fee. Unlike Square, which offers a free POS system, Zettle charges for its card reader and terminal but offers a variety of features for the price.

Pros and cons

Pros:

- Fast and secure payments across multiple platforms.

- Variety of payment solutions, including gift cards and payment links.

- No extra fees for bank transfers; funds typically arrive within minutes in your PayPal Business account.

- Customizable transaction fees.

Cons:

- Card transaction fees are on par with Square but slightly higher than SumUp.

- Extra cost for hardware like card reader and terminal.

- Invoicing fees could add up, depending on the volume of invoices you send.

4. myPOS

Founded in 2014, MyPOS has established itself as a comprehensive payment solution provider, focused primarily on the European market. With a range of offerings such as POS terminals, online payment gateways, mobile apps, and electronic vouchers, MyPOS serves various sectors like retail, hospitality, transportation, and e-commerce.

It’s particularly known for its instant settlement feature and multi-currency support, making it an appealing choice for businesses of all sizes, including SMEs and larger corporations.

Features

MyPOS’s instant settlement feature offers businesses immediate access to funds right after processing a transaction. This confers a significant advantage over conventional providers that often entail waiting periods for fund clearance.

MyPOS supports a wide range of payment methods, including credit/debit cards, NFC payments (such as Apple Pay and Google Pay), and even QR code payments. It can also facilitate transactions in multiple currencies, which is beneficial for businesses catering to international clients or considering global expansion.

Pricing comparison

MyPOS operates on a pay-per-use model with no monthly or annual fees, unlike Square which has specific transaction costs but also offers a free POS system.

MyPOS’s online card payments are charged at 1.25%, significantly lower than both Square and Zettle, while in-person payments are charged at 0.25% for debit cards and 1.75% for credit cards. POS terminal costs range from £119 to £349, depending on the model.

Pros and cons

Pros:

- MyPOS offers a wide range of versatile payment options, including credit/debit cards, NFC, and QR codes.

- With multi-currency support, MyPOS is ideal for businesses with international operations or those planning to scale globally.

- Instant Settlement provides immediate access to funds, which improves cash flow, particularly for smaller businesses.

Cons:

- Although there is no monthly fee, businesses with high sales volume may find the transaction charges of MyPOS accumulating over time.

- Lacks some of the advanced features that competitors offer.

- Some users have reported slow customer service response times.

5. Takepayments

Takepayments is a UK-based payment solutions provider aimed at making the payment process as simple as possible for businesses.

Offering a range of options including in-store, online, and mobile payment methods, Takepayments tailors its services to suit your specific business needs. Supported by a UK-based customer service team available seven days a week, the platform offers custom pricing packages.

Features

Takepayments provides a unique approach to pricing, offering personalized packages that depend on the nature of your business and card types. A card payment specialist works with you to understand your business and tailor a pricing package accordingly.

The company offers a variety of countertop, portable, or mobile card machines – as well as tPOS systems to help streamline the management of your business operations.

There are no monthly or annual merchant account fees, making Takepayments an attractive option for many businesses.

Pricing comparison

Takepayments stands out for its personalized pricing strategy. Transaction rates can vary between 0.3% to 2.5% depending on the card and the nature of your business, plus a flat fee.

In contrast, Square, MyPOS, and Zettle offer fixed transaction fees. However, Takepayments does have a minimum monthly charge of £10+ and optional PCI compliance fees.

Pros and cons

Pros:

- Tailored packages offer flexibility and can be more cost-effective depending on your business needs.

- From card machines to tPOS systems and online payments, Takepayments offers a comprehensive suite of payment solutions.

Cons:

- The platform has a minimum monthly charge of £10, which could be a drawback for smaller businesses.

- While optional, some businesses might find the £35/year fee for PCI compliance to be an extra cost.

Comparing the options

| Grafterr GO | SumUp | Square | Zettle | MyPOS | Takepayments | |

|---|---|---|---|---|---|---|

| Transaction Fees | 1.29% | 1.69% | 1.75% | 1.75% | 0.25-1.75% | 0.3-2.5% + flat |

| Hardware Costs | £16 | £29-£99 | £16-£399 | £29-£149 | £119-£349 | N/A |

| Integration | Free POS App | Basic | Yes | Basic | Yes | N/A |

| Customer Support | Free unlimited | Yes | Yes | Unknown | Limited | 7 days a week |

| Monthly Fees | £0 | None | None | None | None | None (£10+ min) |

| Funds Payout | Next working day | 1-2 days | Next business day | Minutes to PayPal | Immediate | Not specified |

Choosing the right option for your business

Choosing the right payment system is a critical decision for businesses of all sizes and sectors. The ideal system not only offers the lowest possible transaction fees but also comes with an array of features designed to simplify operations and enhance the customer experience.

The market for payment systems is robust and competitive, with providers vying to offer better features, lower fees, and improved customer service. By carefully evaluating each system based on crucial parameters like transaction fees, hardware costs, and customer support, businesses can choose the most appropriate solution that aligns with their operational needs and growth objectives.

Want to learn how Grafterr GO! can help your business? Check out the options and features online, and see how Grafterr GO! is helping UK companies reduce their transaction fees and save money on operations. Get started today and see how Grafterr GO! is revolutionizing the way businesses process payments.