The Point of Sale (POS) system is a foundational tool in the retail and hospitality sectors. For businesses in the UK, staying updated with the latest POS advancements and understanding its nuances is paramount. Here, we delve into the top 5 frequently asked questions regarding POS systems in the UK context, offering you comprehensive, SEO-friendly insights.

1. What exactly is a point of sale (POS) system, and why is it essential for UK businesses?

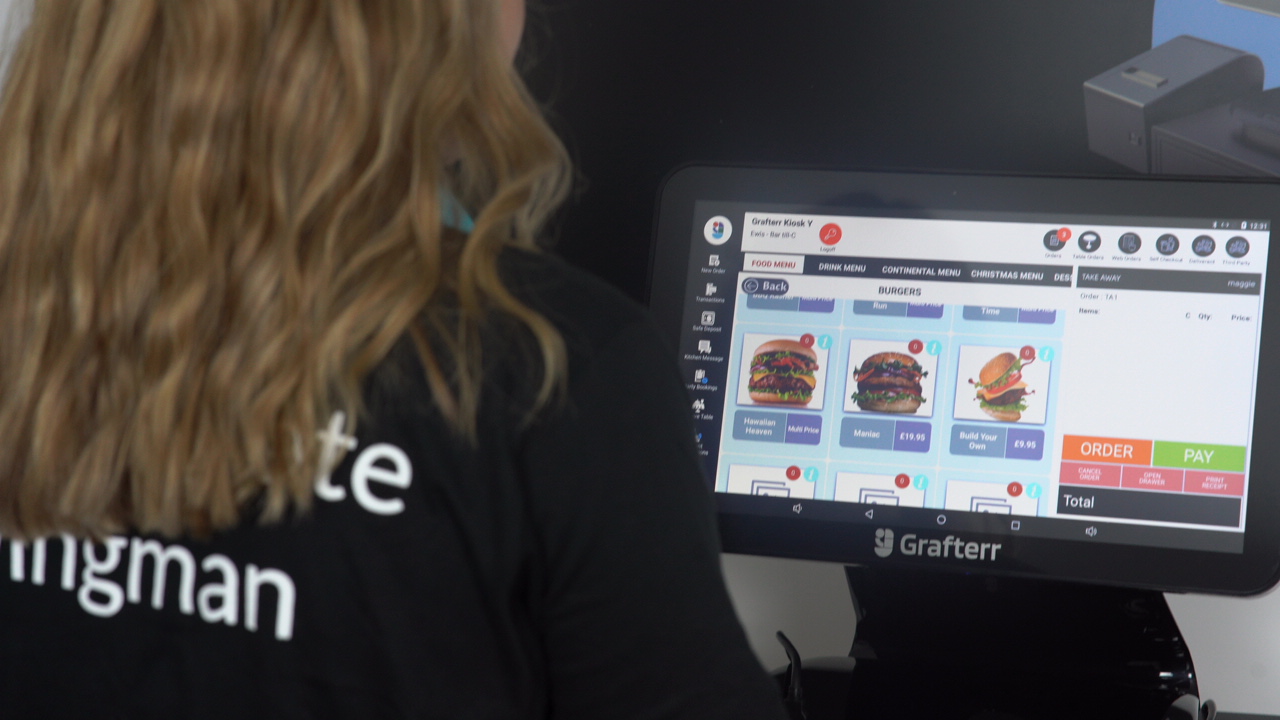

A POS system, in its essence, refers to the place where a customer completes a transaction. It encompasses both the hardware (like the cash register or the electronic device used) and the software that records the sale.

Relevance to UK Businesses:

- Digital revolution: The UK has witnessed a massive shift towards digital transactions. POS systems align with this trend, facilitating seamless digital payments, and helping businesses stay competitive.

- Inventory management: Modern POS systems track inventory in real-time, allowing UK retailers to optimise stock levels, reduce wastage, and enhance profitability.

- Data analytics: The UK’s competitive market landscape necessitates data-driven decisions. POS systems provide insights into sales trends, customer preferences, and peak selling times.

2. Are all POS systems the same, or are there different types tailored to specific business needs?

No, all POS systems are not the same. Depending on the business type, size, and specific requirements, there are multiple POS options available.

Different Types of POS Systems in the UK:

- Retail POS: Tailored for shops and stores, focusing on inventory management and sales analytics.

- Restaurant POS: Designed for eateries, emphasising order management, table assignments, and seamless kitchen communication.

- Mobile POS (mPOS): For businesses on the go, like pop-up shops or market stalls in the UK. They offer flexibility and operate through tablets or smartphones.

3. How do POS systems handle tax regulations in the UK?

Tax compliance is a significant concern for UK businesses. Fortunately, advanced POS systems are designed to stay updated with the latest tax rates and regulations.

Features for tax compliance:

- VAT management: POS systems automatically apply the standard UK VAT rate (or reduced rates where applicable) to transactions.

- Tax reporting: Generate tax reports effortlessly, ensuring businesses stay compliant with HMRC requirements.

- Digital records: With the UK moving towards digital tax management, POS systems store digital records, streamlining submissions.

4. Is the data stored in POS systems secure, considering the UK’s stringent data protection laws?

Yes, modern POS providers prioritise data security, ensuring that they comply with the UK’s Data Protection Act and GDPR regulations.

Security measures in place:

- Encryption: Data is encrypted during transactions to prevent breaches.

- Regular updates: POS software providers in the UK regularly release security patches to address potential vulnerabilities.

- Compliance checks: Many POS providers undergo periodic audits to ensure they maintain the high data protection standards set by UK law.

5. How do POS systems facilitate loyalty programmes and customer management in the UK retail landscape?

Customer retention is crucial in the saturated UK market. POS systems play a pivotal role in fostering loyalty and enhancing customer relationships.

Loyalty Facilitation Features:

- Loyalty points: Businesses can set up loyalty programmes where customers earn points for purchases, redeemable for discounts or free items.

- Personalised marketing: POS systems store purchase histories, allowing UK businesses to tailor marketing campaigns based on individual preferences.

- Feedback mechanisms: Many POS systems have built-in feedback tools, enabling businesses to gather customer opinions and improve services.

Conclusion

The POS system has transformed from being a mere transactional tool to an integral part of a business’s operational and strategic framework, especially in the UK. By understanding these frequently asked questions, UK businesses can leverage the full potential of their POS systems, ensuring efficiency, compliance, and enhanced customer relationships.