Contactless payments have increased rapidly in the last few years, with close to 90% of face-to-face transactions carried out with contactless cards in 2022 – compared to 65% in 2019. Subsequently, one of the innovative technologies responsible for this growing trend is NFC Payments.

Let’s take a closer look at NFC technology, how it works, and the benefits it offers businesses.

What is NFC?

Near-field communications (NFC) is a wireless data transfer standard similar to Bluetooth and radio-frequency identification (RFID) technologies. NFC technology allows devices, such as smartphones, tablets, and laptops, to share data when within a few cm of each other.

Consequently, this makes NFC (technology) ideal as a contactless payment technology. This is why it’s used in mobile wallets, like Apple and Google Pay, and contactless credit and debit Cards.

How Does NFC Work?

In short, NFC technology works through the process of two NFC devices exchanging data when they come into close proximity to each other. Typically, and as is the case with contactless payment technology, one NFC device acts as the reader, which receives and processes data, while the other transmits the data when it’s within range.

Better yet, in the context of contactless payment solutions, an NFC device can emulate, i.e., act like, an NFC card. This means that it can be used by consumers in place of a contactless credit or debit card, offering a quick, secure, and convenient way to make payments.

Is NFC Safe?

Naturally, one of business owners primary concerns when it comes to NFC technology how secure it is and, subsequently, if it leaves both them and their customers vulnerable to fraud. Fortunately, NFC mobile payments are not only secure but are actually safer than traditional payment methods for several reasons:

In essence, an NFC mobile payment is protected by two layers of security: data encryption and the mobile device itself.

The payment data is encrypted by advanced cryptographic protocols as soon as the NFC devices make contact, so malicious actors can’t intercept it.

If the customer’s device is lost or stolen, its passcode or biometric security (facial, iris or fingerprint scan) prevents its use. If a customer loses their contactless card, on the other hand, it can be used until they realise and report it.

A customer’s payment data is only exposed once with a mobile wallet: when their device connects with a reader. More importantly, the card details are never fully revealed.

What Are the Benefits of NFC?

Increasing numbers of businesses have seen the considerable advantages of accepting NFC payments, which is why the number of NFC payment terminals in use is projected to grow from a recorded 80 million in 2020 to 127 million by 2025.

With that in mind, here are the main benefits of NFC technology – and contactless payment solutions in general:

Speed: Contactless payment methods, like NFC technology, are quicker than traditional methods, like cash and swipe-able cards. Subsequently, this cuts down customer queuing times.

Convenience: NFC technology allows your customers to make purchases with a mere tap or wave of a smartphone or card, making transactions quick and seamless. Not to mention, many customers already have their phones in their hands as they approach the point of sale.

Security: Contactless payment solutions use advanced encryption technology to protect sensitive financial data. Plus, in the case of mobile wallets, they also benefit from the device’s security measures.

Increased Accessibility: NFC payments offer an easier way for people with disabilities or mobility issues to complete purchases.

Reduced Touch Points: One of the key reasons why contactless payment technology gained popularity so rapidly is that they reduce the need for physical contact during transactions, which is essential for reducing the spread of germs.

Low Power Requirements: NFC technology consumes less power than Bluetooth- powered contactless payment solutions, which prevents the need to recharge reader devices as often.

Loyalty: NFC mobile payment solutions make it easier to implement a loyalty program. A business can seamlessly track customer transactions and accumulated points while collecting analytics on its customer base and locations. Its customers, meanwhile, can redeem their rewards with no more than a tap of their phone.

Enhanced Customer Experience: All of the above – quicker transactions, shorter queues, greater accessibility, added convenience, etc., combines to create a better customer experience.

How Do I Get Started with Contactless Payments?

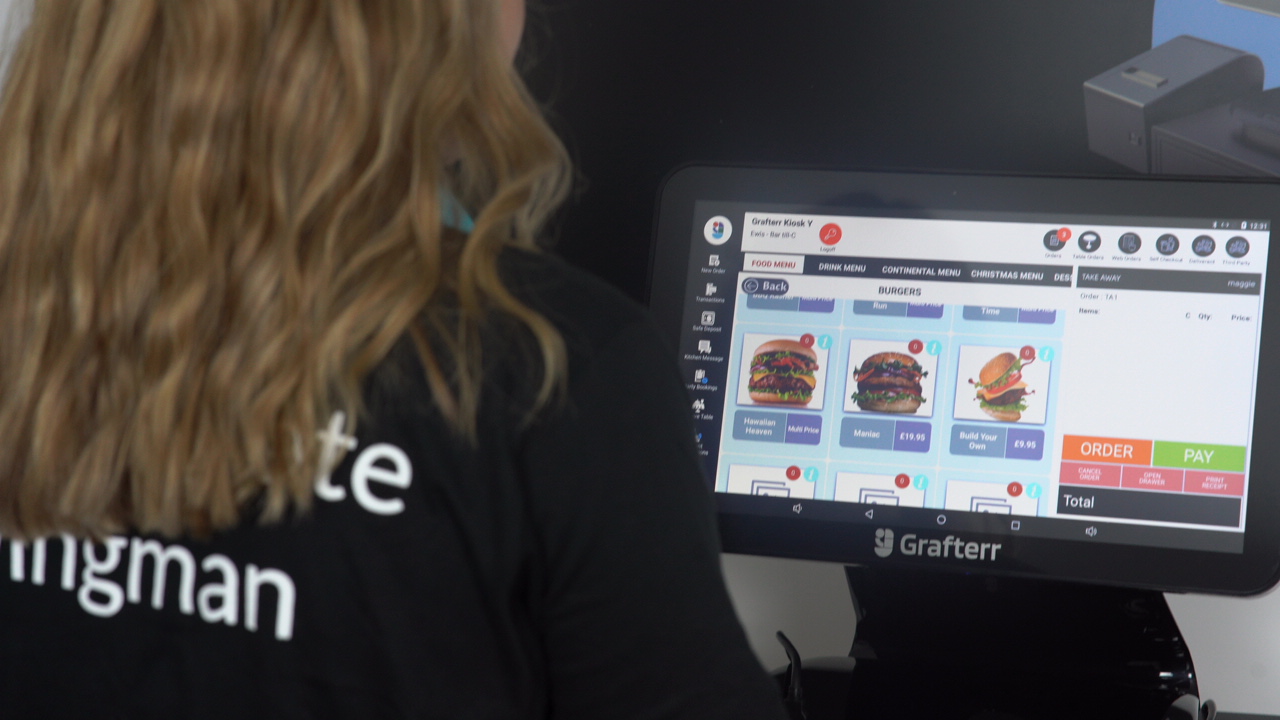

If you want to start accepting contactless payments in your business, look no further than Grafterr GO! With tap on phone functionality, users can begin transacting instantly, reducing start-up costs. GO! has been in beta testing since late 2022. More than 1,000 users have downloaded the app, powering 25,000 customer transactions and almost £1 million in revenue for UK-based SMEs.

The Grafterr GO! app transforms a smartphone or tablet into a contactless payment reader – so there’s no need for a dedicated terminal. Better still, Grafterr GO! is:

- Free: sign up at no cost and start taking contactless payments instantly.

- Easy: simply connect a mobile device to a printer and cash drawer for complete POS set-up.

- Quick: receive customer payments with the tap of their contactless card or mobile device.

As of now, Tap-on-phone feature is only available for NFC enabled Android phones. We are awaiting Apple’s approval to be able to offer Tap on phone to all of our Apple users as well.

Download the Grafterr GO! app from the Google Play Store and start taking contactless payments instantly, or visit www.grafterr.com/uk/go for more information.