The UK has witnessed a significant shift towards a more digital economy, with QR codes and digital payments leading the charge. This trend, accelerated by the global pandemic, shows no signs of slowing down.

Initially, the shift towards QR and digital payments in the UK was met with resistance, fueled by concerns over job security within the hospitality industry.

Critics argued that automating processes traditionally handled by staff, such as taking orders and processing payments, could lead to widespread job losses.

The fear was that technology, despite its efficiency, might replace the human touch that is so integral to the hospitality experience.

This resistance highlighted a broader anxiety about the pace of technological change and its impact on the workforce, with many worried that the push for digitalization would prioritize convenience over livelihoods.

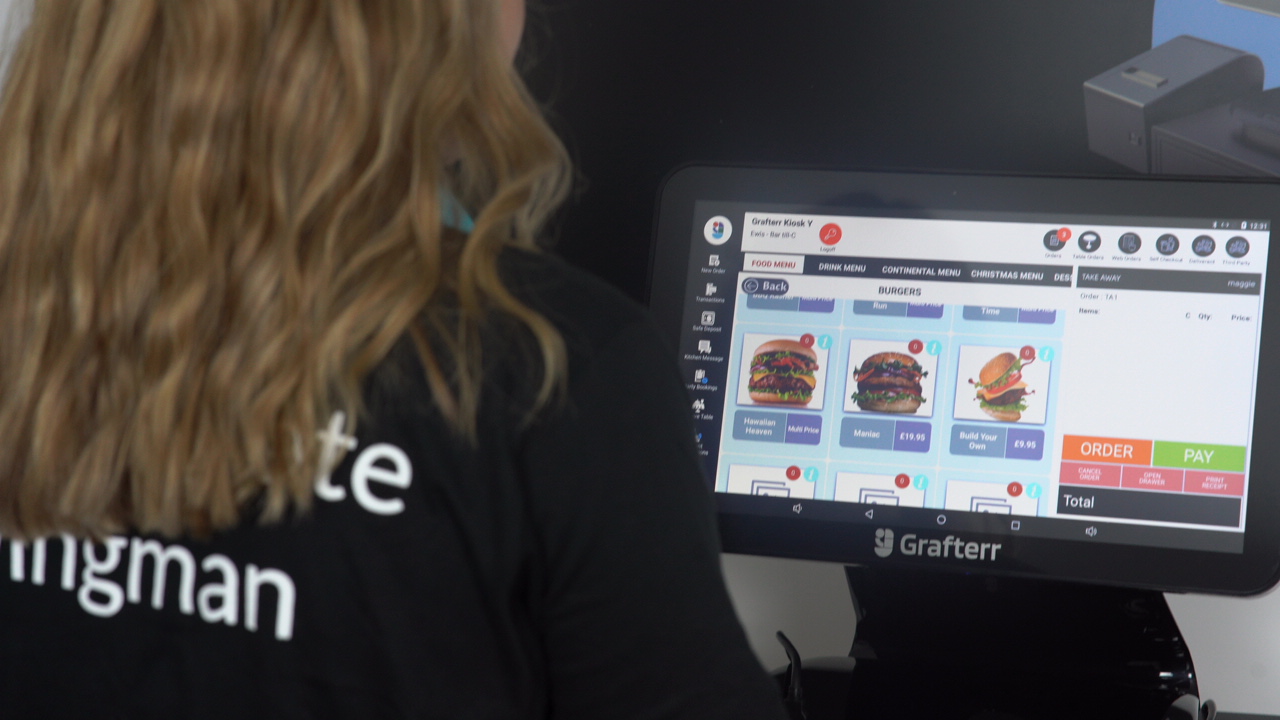

However, as the adoption of QR codes and digital payments gained momentum, especially in the food and drink sector, it became clear that these technologies complemented rather than replaced human service.

Businesses found that digital menus and payments could cater to a wider range of customer preferences, including those of international tourists who valued the ease and familiarity of digital transactions.

The ability to browse menus in multiple languages, explore options at their own pace, and pay securely in their preferred method enhanced the dining experience for visitors from around the globe.

This adaptability proved particularly valuable in the UK, a country known for its vibrant tourism industry. Rather than eliminating jobs, the integration of QR and digital payments allowed staff to focus on higher-value tasks, such as improving customer service and engagement, ultimately leading to a more dynamic and inclusive hospitality environment.

Let’s delve into the factors driving this change and what it means for businesses and consumers alike.

The catalyst for change

- Contactless Necessity: The COVID-19 pandemic highlighted the need for contactless transactions, pushing QR and digital payments from convenience to necessity.

- Consumer Expectations: Modern consumers, accustomed to digital solutions, began demanding faster, safer, and more convenient payment options.

- Global Trends: The global shift towards digital banking and fintech innovations influenced UK market trends, encouraging a move away from traditional cash transactions.

- Technological Advancements: Improvements in smartphone technology and mobile internet accessibility made QR and digital payments more reliable and user-friendly.

- Regulatory Support: Regulatory bodies and financial institutions began advocating for digital payments to enhance financial security and combat fraud.

- Sustainability Concerns: Growing awareness of environmental issues spurred interest in reducing the use of physical currency and paper receipts.

- Business Efficiency: Businesses recognized the operational efficiencies gained from digital payments, including streamlined accounting and inventory management.

- Tourism and Diversity: The UK’s status as a top tourist destination created a need for versatile payment systems to accommodate international visitors.

- Safety and Hygiene: Health and safety concerns, particularly around the transmission of germs through cash, boosted the appeal of QR and digital payments.

- Competitive Advantage: Businesses saw an opportunity to differentiate themselves by offering advanced digital payment solutions, attracting tech-savvy customers and enhancing the overall service experience.

Benefits of QR and digital payments

- Speed and efficiency: Transactions are faster, reducing wait times and improving customer experience.

- Enhanced security: Digital payments often come with advanced security features, reducing the risk of fraud.

- Accessibility: Anyone with a smartphone can make or receive payments, broadening access to digital transactions.

For consumers, the convenience and speed of completing transactions with just a few taps on their smartphones enhance the overall experience, reducing wait times and eliminating the need to carry cash.

Businesses, on the other hand, benefit from improved operational efficiency, as digital payments streamline the processing of transactions, reduce errors, and facilitate easier record-keeping and financial management.

Additionally, the inherent security features of digital payments, including encryption and tokenization, significantly lower the risk of fraud and theft, offering peace of mind to both parties.

The environmental impact cannot be overlooked either, as moving away from paper-based receipts and cash reduces waste and supports sustainability efforts.

Overall, QR and digital payments not only cater to the growing demand for faster, safer, and more convenient payment methods but also align with broader trends towards digitalization and environmental responsibility.

Tips for businesses integrating QR and digital payments

- Educate your staff: Ensure your team understands how to process QR and digital payments and can assist customers.

- Promote adoption: Encourage customers to use digital payments by highlighting their benefits, such as safety and convenience.

- Offer incentives: Consider discounts or loyalty points for customers who use QR codes or digital payment methods.

The future landscape

The trajectory of QR and digital payments in the UK points towards a future where cash transactions become increasingly rare. Businesses that adapt to this change can expect to:

- Attract a wider customer base: Especially younger, tech-savvy consumers who prefer digital transactions.

- Streamline operations: Digital records of transactions make accounting and inventory management easier.

- Stay competitive: As more businesses adopt digital payments, those who don’t risk being left behind.

Conclusion

The rise of QR and digital payments in the UK marks a significant shift in how transactions are conducted.

For food and drink businesses, the transition to digital offers a chance to streamline operations and enhance customer satisfaction. For consumers, it promises greater convenience and security.

As this trend continues to evolve, staying informed and adaptable will be key to success in the digital economy.