Although the digital revolution in the payment and banking industry was well underway by 2020, the pandemic accelerated the process. Suddenly unable to purchase goods and services as accustomed, millions of consumers turned to contactless payment methods for the first time. Subsequently, one of the payment options that saw a substantial increase in adoption was pay by link.

In this post, we look at pay by link, how it works, and the advantages this increasingly popular payment method can bring to your business (or a side hustle).

What is pay by link?

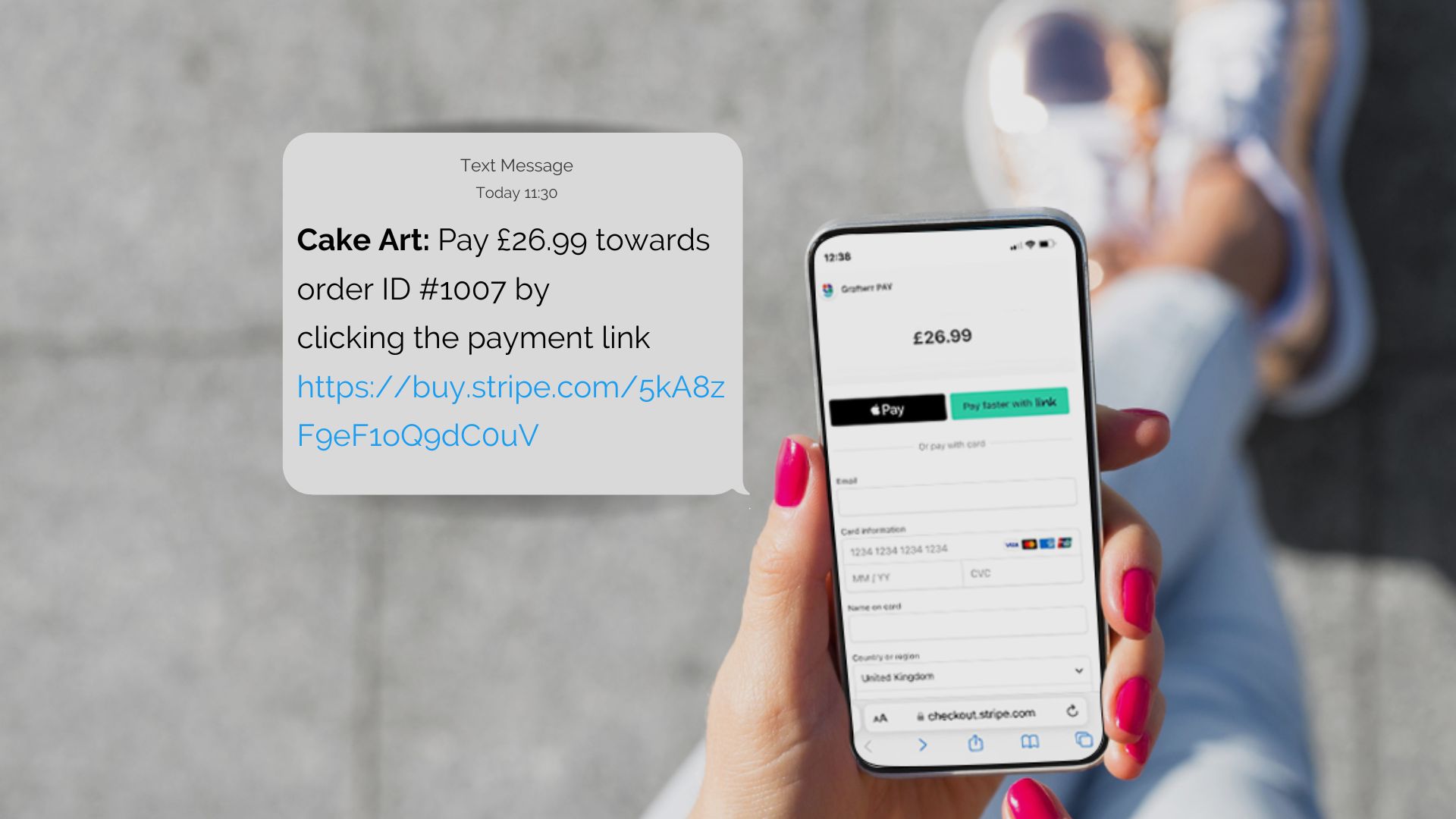

Pay by link is an all-online payment solution that enables your customers to pay for your business’ products and services. In short, pay by link lets you send your customers secure payment links via email, text, social media, and even through a chatbot. Subsequently, it allows you to get paid online even if you don’t have a website.

How does pay by link work?

First, pay by link software generates a unique payment link and sends it to your customer. Upon receiving and clicking the link, your customer will be taken to an encrypted payment page detailing their transaction. From there, they have to fill in their payment details, and the transaction will be complete.

Sounds great, right? Now, when you consider that many consumers have payment details already saved on their mobile devices, with Google or Apple Pay, for instance, the entire above process can be even smoother.

Is pay by link safe?

Pay by link is a highly secure payment method, primarily because it employs the same security protocols as any other online card transaction, such as 3-D Secure (3DS). The payment link generator must also comply with data security and privacy legislation such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard).

A key aspect of pay by link to bear in mind is that although the instant payment link is sent by email, text, etc., the user has to be redirected to a secure payment page to complete the transaction. Subsequently, none of the customer’s sensitive data, or personally identifiable information (PII) is transferred with the payment link itself.

What are the benefits of using pay by link?

The list of advantages of using pay by link for SMEs is actually quite substantial:

Quick and simple

Much like when Amazon pioneered one-click purchases in 2000, pay by link makes it easier for customers to complete purchases.

Increased revenue

By removing friction from the customer buying journey, such as security worries, pay by link helps vendors increase transaction conversion rates.

Flexible

As well as sending payment links for catalogued products or services, you can use pay by link to secure deposits, start subscriptions, take donations, or accept any other custom amount.

Easy to share

Payment links can be immediately sent via the customer’s preferred method of communication: email, text, etc., for added convenience.

No website required!

The way that pay by link works means that you don’t have to have an online store to accept payments through the internet. This is ideal for new businesses who haven’t got around to designing a site yet, or established companies in the middle of a website upgrade or re-brand.

No need to share card details

Pay by link provides a handy alternative to customers having to share their details over the phone. This is more secure and, subsequently, will put some customers’ minds at ease.

No need for card machine/receipt printer

Pay by link allows you to accept card transactions without the need for a card machine or terminal. If the customer is on the premises, you can still send them a payment link for them to pay by credit or debit card instantly from their phone. As an added benefit, transaction receipts can also be immediately generated and sent to their e-mail, removing the need for a paper copy.

Customers pay at their convenience

Another benefit of pay by link is that customers can complete purchases at their leisure – 24 hours a day. Plus, the email or text through which they were sent the link acts as a gentle payment reminder.

Real-time reporting

Typically, each payment link is tracked by analytical software that enables you to generate reports on their status and performance. These reports will give you insights you can use to refine your sales and marketing strategies and, ultimately, boost your bottom line.

How to get started with pay by link

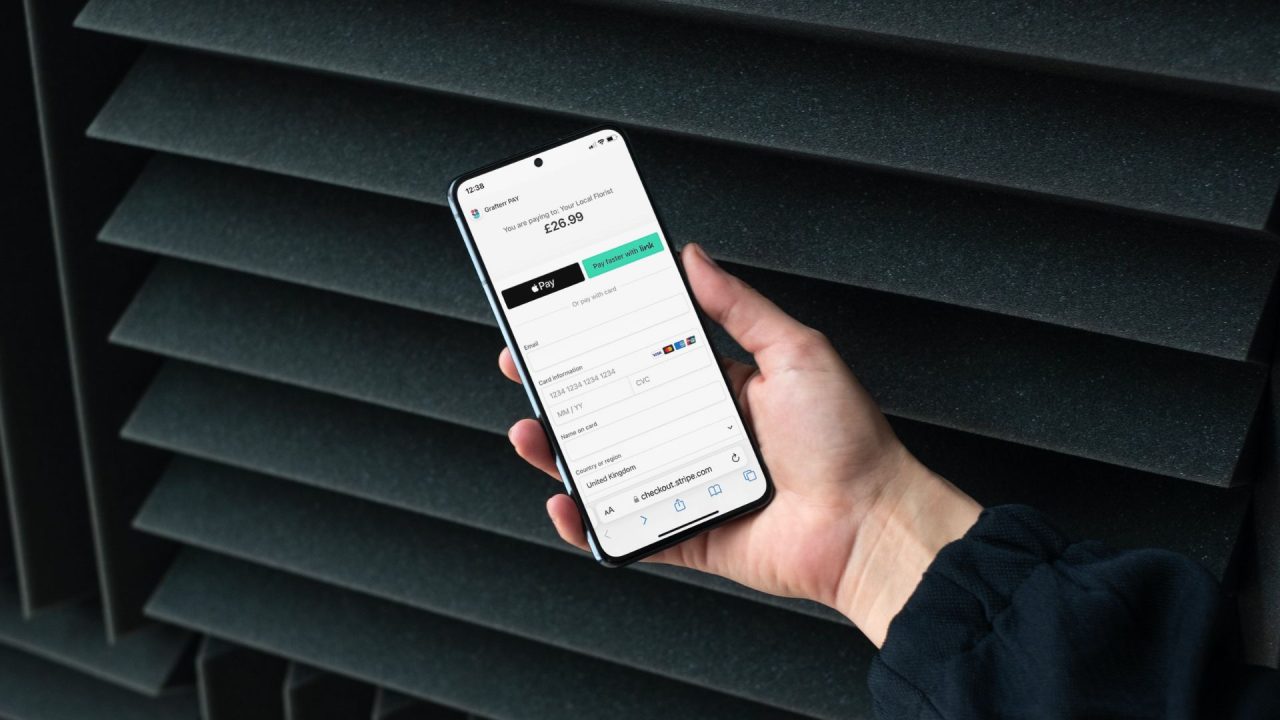

As it happens, our own Grafterr GO! payment app provides a powerful, simple, and, best of all, free way to start using pay by link at your business. You can use it to send your customers secure payment links by email or text, giving them the convenience of securely paying online even if you don’t have an e-commerce website.

Grafterr GO! app is perfect for small and medium businesses, freelancers, and tradespeople. Check it out on the Apple App Store or Google Play Store.