SumUp offers a range of opportunities tailored for small businesses and entrepreneurs. Their primary service is providing card readers that allow companies to accept card payments easily, even on the go.

Their card readers can connect to smartphones or tablets, making transactions convenient.

The company also offers a point-of-sale system, online invoicing, and data collection. Their services revolve around simplifying payment processing in multiple categories.

How has payment processing evolved?

Cheques were the initial way to accept payments for those who didn’t want to use cash. Although the transaction could be time-consuming, it did offer a way to carry fewer bills.

Credit cards were introduced in the late 1950s to the public, but a “tab” or “credit line” was extended to customers by stores, banks, and others to facilitate purchases.

The 1980s saw the rise of electronic payment terminals, allowing merchants to process credit and debit card transactions electronically. This technology sped up payment processing and reduced our reliance on paper.

With the advent of smartphones, mobile payment options like Apple Pay, Google Wallet, and mobile banking apps emerged. This technology allowed customers to make payments on their phones or tablets and let businesses accept them on the go.

Today, NFC enables a contactless to take payments. Consumers can tap their cards or smartphones on the payment terminal for a quick transaction. QR codes, biometrics, and P2P options all offer convenience.

Each method also delivers transaction fees to the merchants.

Why are transaction fees charged?

Payment processors charge a transaction fee for several reasons. Any or all of the following could be involved in this cost.

- Providing Services. Payment processors offer a service that enables businesses to accept electronic payments, including secure gateways, fraud detection, and customer support.

- Risk Mitigation. The processor often assumes certain risks with the transaction, including chargebacks and disputes.

- Regulatory Compliance. Payment processors must adhere to various financial regulations and standards, which involves legal and compliance costs. These expenses are funded through fees.

- Research and Development. New features that improve user experiences require a monetary investment to develop. The processing fees help with this expense.

Payment processors offer the convenience of various payment methods for merchant services, making it easier for businesses to accept a wide range of transactions. The fees cover the convenience and accessibility provided.

You can pass this cost along to their customers in many circumstances, but there are pricing considerations to manage. If you can keep your expenses low in this area, you can be more competitive in your industry.

Criteria for evaluating each payment processing alternative

Choosing the right payment processor is crucial for your business. When evaluating SumUp’s competitors, we looked at several data points.

- We compared transaction fees, processing rates, and any extra charges merchants would be asked to pay to use the service.

- Our team identified the accepted payment types, including credit cards, mobile payments, and online transfers.

- We looked at the APIs to determine if they were developer-friendly for those requiring custom integration.

- Then we reviewed processing times, including settlement timeframes, to rate what to expect.

We highly recommend choosing a payment processor with a strong track record of providing excellent uptime ratings and consistent outcomes.

List of the leading payment processor alternatives to Sumup in the UK

Approximately 1,300 payment processors are registered for operations in the UK at some level. Using the evaluation criteria, we have pared down this list to the top five alternatives for those looking to accept payments or change providers.

Here is a closer look at our top choices for payment processors that aren’t called SumUp (Stripe payment processing did not make this list!).

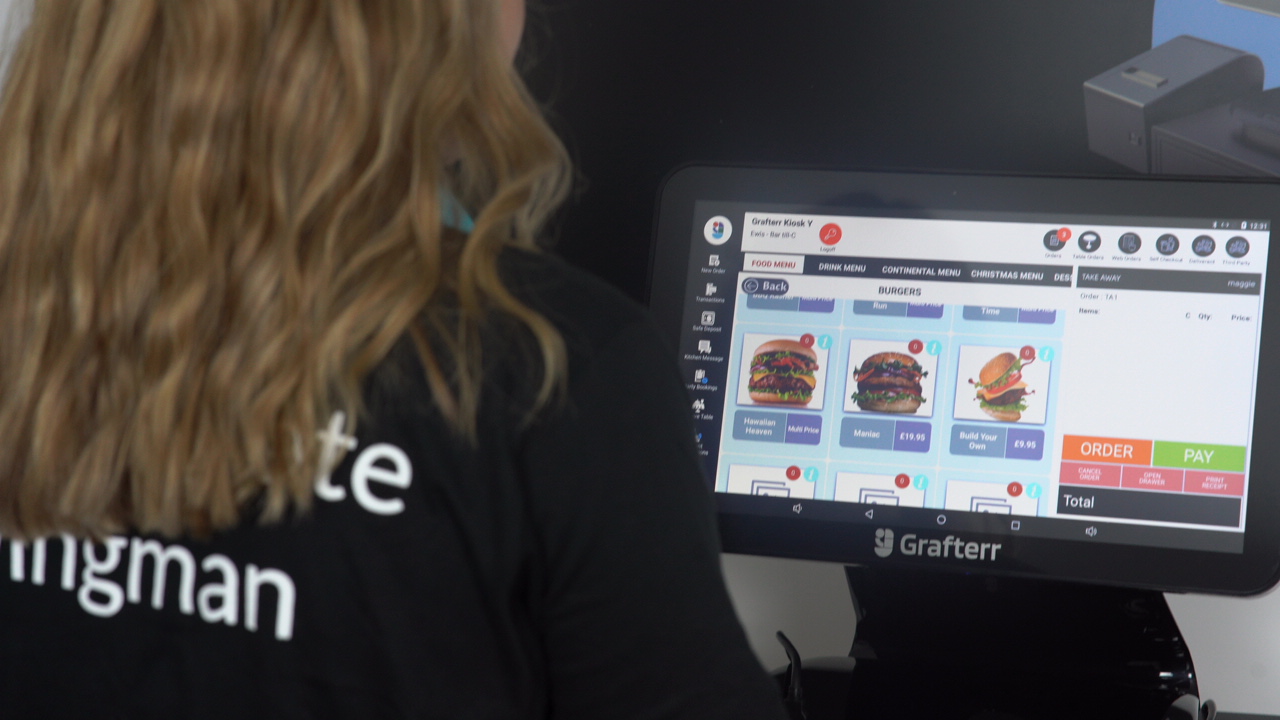

1. Grafterr GO!

Grafterr is a payment processing platform that simplifies financial transactions for businesses and individuals. It allows companies to accept various forms of payment, such as credit cards and digital wallets.

This system securely manages payment information and facilitates seamless transactions.

Grafterr employs advanced encryption and security measures to protect sensitive financial data. It integrates with online stores and POS terminals, making it versatile for different business setups.

How Grafterr GO! Compares with SumUp

Grafterr’s card reader is £16 less than SumUp’s option. You’ll also pay a 1.29% transaction fee instead of 1.69% while receiving a next-day payout. These rates are some of the best in the industry today, even beating the other alternatives out there to save your business money.

It’s one of the most affordable ways to have a credit card machine for small business transactions. You can accept payments without passing significant costs to your customers.

Any business in any industry can take advantage of these fantastic rates. You get affordability without compromising the quality of the payment processing needed to facilitate transactions.

2. Square

Square is a comprehensive payment processing solution geared towards businesses of all sizes. It enables merchants to accept payments through various channels, including in-person and mobile transactions.

This platform offers a range of business management tools beyond payment processing, such as inventory management, appointment scheduling and customer relationship development.

Square payment processing uses a flat-rate system to simplify budgeting while providing several e-commerce tools to integrate payment processing into your online presence.

How Square Compares with SumUp

Square is like a Swiss Army knife, offering many features beyond a basic transaction, such as point-of-sale systems, online stores, and invoicing. SumUp is more like a reliable wrench – straightforward, focused on payments, and designed for simplicity.

Square’s versatility makes it suitable for businesses with diverse needs. Their entry reader is cheaper, and the company offers five reporting tools compared to SumUp’s three.

Outside of the credit terminal difference, the costs are similar. You’ll save a little on your transaction fees with Square, but the rest of the experience is essentially equal.

3. Zettle

Zettle is a payment processing platform designed to cater to small businesses and entrepreneurs. It offers a simple and convenient way to accept various credit cards and mobile wallets.

You receive a compact card reader that can be connected to smartphones or tablets, turning them into portable payment terminals. The platform also offers basic inventory management features, helping businesses keep track of their products and sales.

It focuses on simplicity so that you can grow your small business or scale upward as needed.

How Zettle Compares with SumUp

Zettle emphasizes an elegant and user-friendly interface. The attention to detail shines, making it a preferred option for those who prefer a high-quality user experience with their payment processors.

SumUp focuses on reliability by keeping things as simple as possible. It is a little easier to perform the initial setup.

Zettle’s entry reader is about 30% cheaper than what you’ll purchase from SumUp, but it is more expensive than Square.

Both services provide similar outcomes when processing transactions. Zettle is slightly better for small businesses and startups. At the same time, those with an established presence could benefit from SumUp’s transparent (but more expensive) pricing system.

4. myPOS

With myPOS, you have a modern solution that empowers businesses to accept credit card payments. It’s like a portable point-of-sale system that lets you process transactions securely.

Whether you’re a small vendor in a market or a growing business, myPOS offers tools to manage payments conveniently and expand your reach.

It delivers a user-friendly interface with versatile features, making it an asset for streamlining payment processes.

How myPOS Compares with SumUp

You’ll find myPOS is like a scenic drive, offering many features, including payment processing, card terminals, and even business banking services. It gives you the feeling of taking the scenic route when you have time to spare, offering a comprehensive solution for a business wanting an all-in-one solution.

SumUp is more like a direct flight. It lets you get to your payment processing destination with a simplified travel itinerary.

myPOS charges the same as SumUp for the reader. You can potentially save on transaction fees, as myPOS charges between 1.1% and 2.85% plus 7p, while SumUp has a flat 1.69% rate for all cards.

5. Takepayments

Takepayments aims to help businesses of all sizes process payments efficiently and securely. This processor offers tailored solutions for all companies and industries, including pop-ups and solo entrepreneurs.

If you need credit card processing, this resource simplifies the process. You can quickly take transactions for customers and receive your funds quickly.

How Takepayments Compares with SumUp

Takepayments is like a well-equipped expedition, offering payment processing and a range of additional services such as ePOS systems and online payments.

SumUp is more like taking a guided journey to an exciting destination you’ve planned well in advance. It is straightforward, while Takepayments looks all-inclusive as a payment processor.

Takepayments requires a 12-month contract, but there is no initial cost. You will pay £25 monthly for the services, but the transaction fees can be as low as 0.3% based on your status. Settlements are one working day.

SumUp offers a money-back guarantee, but Takepayments does not.

Why it makes sense to re-evaluate your payment processor?

If you don’t have a payments processor right now that lets you manage transactions on the go, you should consider investing in one to expand your business opportunities.

When you have a reliable processor, staying in a comfort zone of success can be tempting. It is still wise to compare all options to see if you can provide the same or better services with fewer costs.

With cyber threats evolving, a payment processor with advanced security features can better safeguard your business and customer data. Re-evaluation ensures your payment processor aligns with your current business needs, helping you enhance efficiency and protect your bottom line.

SumUp has a history of providing excellent services in a straightforward manner. With these five top alternatives, it is clear to see that you have several excellent choices to consider.